Introduction

Markets are moving—and fast. One day the S&P 500 climbs, the next the Nasdaq dips. Interest rates rise, inflation whispers troubling news. For most people, this feels like background noise. But make no mistake: what happens in markets today shapes your savings, your mortgage, your grocery bill, and even your job security.

Take a moment. That 401(k)? It’s tied to market performance. Your next car loan or home improvement plan? Linked to bond yields. And rising prices at the pump or supermarket? A direct reflection of commodity shifts and inflation.

This article breaks down what’s happening in markets right now, explains why it matters to ordinary households, reveals how it’s already influencing real lives, and offers practical steps you can take to protect—and even grow—your financial future.

What’s the Market Doing Today?

Markets are a bubbling stew of indices, interest-rate moves, commodities, currencies—and yes, it all boils over into your daily life. Here’s a breakdown in simple terms:

Stock Market Snapshot

- S&P 500 is up 1.2% today—a measure of America’s biggest companies.

- Nasdaq is down 0.5%, reflecting a dip in tech giants.

The S&P is like a basket of everyday apples; if tech-heavy apples (Nasdaq) go sour, the whole basket loses value.

Bonds & Interest Rates

Government bonds—you’ve heard of “yields”—are the invisible factors behind loan rates. As yields rise, so does the cost of mortgages and credit cards. Think of bonds as the financial heartbeat of lending.

Commodity Watch

- Oil prices influence everything from your gas bill to the cost of plastics.

- Gold often climbs when investors seek safe havens in uncertainty.

Imagine the price of oil every time you fill your tank—that’s commodities in action.

Currency & Inflation Gauge

A strong dollar lowers prices on imports—electronics, clothing, even overseas vacations. But binding it all is inflation: when the general price level rises, your buying power shrinks.

Why It Matters to You

Why should everyday people track market trends?

Savings & Investments

Short-term market dips can trigger emotional selling. But remember: long-term investing rewards those who stay calm and steady.

Home Loans & Credit

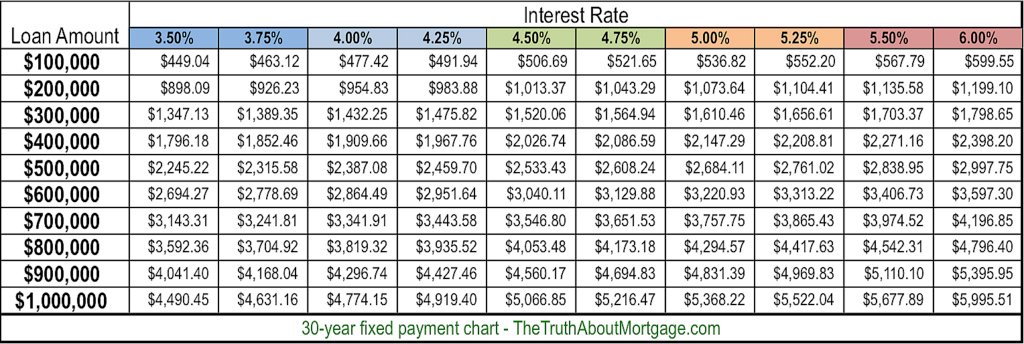

Rising bond yields = rising mortgage and auto loan rates. A 1% rate hike could mean hundreds more per month on a $300K loan.

Jobs & Employment

Tech stocks underperform ⇒ companies may reduce hiring or announce layoffs. Market signals aren’t always perfect—but they do hint at corporate health.

Consumer Goods & Services

Inflation up? That could mean 10–15¢ more per gallon of gas, 20–30% higher restaurant costs, and pricier grocery items.

Take Jenny, a first-time homebuyer: “My $300 K mortgage at 3% would cost me $1,265/month. At 4.5%, that jumps to $1,520—a $255 increase I hadn’t planned for.”

The Ripple Effects on Households

Let’s dive deeper into how real families and businesses feel these trends.

Budgeting & Daily Expenses

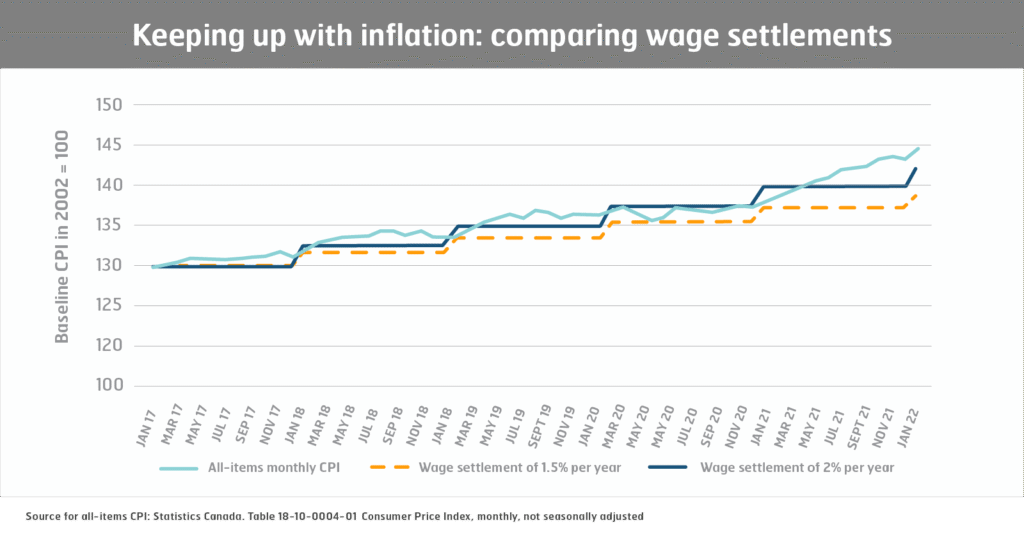

Rising grocery bills and utilities—necessities that blow up household budgets. If food inflation runs at 8% but wages grow 3%, that’s a net loss for families.

Retirement Planning

Volatile markets hit retirement portfolios hard—but remember, drops offer buying opportunities if you’re still years from retirement.

Education & Tuition

College savings plans like 529s fluctuate with markets. Parents may face higher or lower balances heading into tuition season.

Small Business Owners

Interest rates rise → loans cost more → businesses may raise prices or pause expansion.

“We saw material costs go up 12% in six months—that’s forced us to raise prices,” says a local baker.

Smart Moves You Can Make

Here are practical steps to take control of your money—even when markets are unpredictable:

- Build an Emergency Fund: Aim for 3–6 months’ worth of expenses parked in cash or short-term bonds.

- Diversify Your Portfolio: Mix of stocks, bonds, and cash helps cushion volatility.

- Consider Refinancing or Locking Rates: If your loan’s interest rate is adjustable, lock it in—or stay alert for refinancing deals.

- Pay Down High-Interest Debt: Credit cards and payday loans? Pay those off first.

- Use Dollar-Cost Averaging: Invest a fixed amount regularly (e.g., $200/month) regardless of market swings.

Long-Term Trends & What to Watch

Here’s what could shape your financial future over the coming years:

AI & Automation

Advances in AI could displace some jobs—but also create new higher-skilled roles.

Green/Energy Transition

Investment in renewables impacts utility bills, electric vehicles, and energy stocks.

Demographics & Housing

An aging population could push demand for certain housing types, while urban migration shifts home values.

Tech Regulation

Tighter regulations on Big Tech can ramp up investor uncertainty—and sway your portfolio.

Stay tuned for big announcements—Fed decisions, inflation reports, corporate earnings, geopolitics—that may amplify market jitters.

Conclusion

Markets aren’t just for investors—they affect your daily life in real ways:

- Know today’s trends

- Understand how they impact your wallet

- Take proactive steps

- Watch long-term forces at play

We’d love to hear from you:

Poll: Which market story matters most to you—mortgage rates, grocery inflation, job security, or retirement planning?

Share your experience: Has a market trend affected your budget? Tell us in the comments below.

Stay connected: Subscribe for weekly updates straight to your inbox.

Thank you for reading DailyReport. Money moves—and so should your understanding. Stay informed, stay empowered.